bir tin online registration login|eFPS Login Page : Tuguegarao Registration Requirements: Primary Registration • Application for Taxpayer . Tote Jackpot Results for 1st September 2024. Tote Jackpot: No Winner - £10,000 rolled over to next time. Tote Jackpot Prize Fund: £10,000. Race 1 - 2:22 Brighton. Distance: 1m 3f 198y Runners: 6 Favourite: 2. Place No. Name; 1st: 2: Pride Of Nepal (F) 2nd: 4: French Martini: Selections remaining after this race: Tote Jackpot: 2758.05. Horse Name

bir tin online registration login,BIR Form 1904 - Application for Registration of One Time Taxpayer And Persons Registering Under EO 98 (securing a TIN to be able to transact with any government .Registration Requirements: Primary Registration • Application for Taxpayer .Annual Income Tax For Individuals, Estates, and Trusts. BIR Form 1701 - Annual .Capital Gains Tax is a tax imposed on the gains presumed to have been realized .Revenue Regulations (RRs) are issuances signed by the Secretary of Finance, .

Application for TIN. Application for Registration Update. Secondary .Online Registration and Update System (ORUS) is a web-based system that .Note: Username and Password are case-sensitive. Forgot password | Enroll to .

Application for TIN. Application for Registration Update. Secondary Registration. Registration of Book of Accounts. Application for Authority to Print Receipts & Invoices. .

Online Registration and Update System (ORUS) is a web-based system that provides an end-to-end process for registration of taxpayers and updating of their registration .

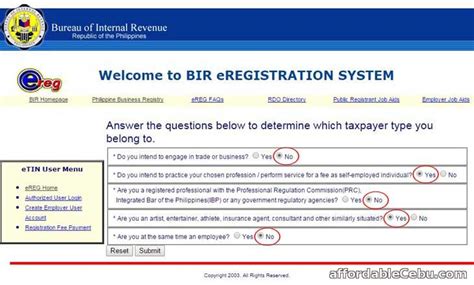

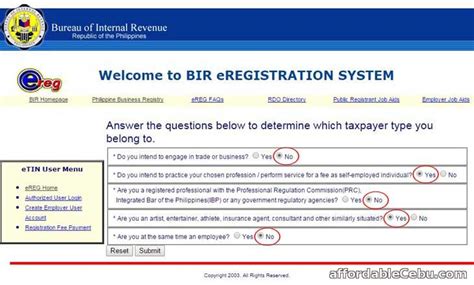

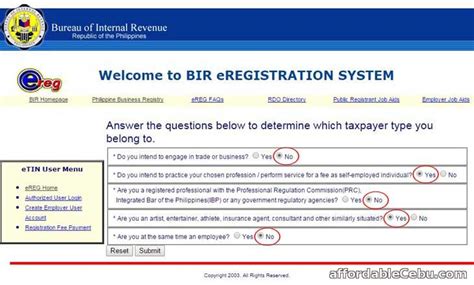

bir tin online registration login eFPS Login Page This article will teach you how to get a TIN number online using Bureau of Internal Revenue (BIR) eReg. The BIR eReg is a web .Secure your eFPS Account You are advised to change your eFPS log-in credentials regularly to protect your account from being compromised. To do this, log-in to your .

The Digital TIN ID is part of the BIR’s Online Registration and Update System (ORUS), where individuals can get a TIN number or update their information. .Note: Username and Password are case-sensitive. Forgot password | Enroll to eFPS | BIR Main| Help. Supported Browsers: Mozilla Firefox version 40 and up; or Google Chrome . Every taxpayer registered with the Bureau of Internal Revenue (BIR) is encouraged to get a TIN ID card or a TIN card as proof of membership. Besides, a TIN .

Step 1. Accomplish the requirements above. Step 2. If registering online, create an account on the ORUS (Online Registration and Update System) website or .

Visit the official website of the Bureau of Internal Revenue to access tax information, eServices, forms, and more.

Primary Registration. • Application for Taxpayer Identification Number (TIN) • Application for Registration Update. Secondary Registration. • Registration of Book of Accounts • Application for Authority to Print Receipts & Invoices • Application for Authority to Use Computerized Accounting Systems and/or Components thereof/Loose-leaf .Pay the ₱30.00 loose Documentary Stamp Tax (DST). Taxpayer-applicant with existing Taxpayer Identification Number (TIN) may pay the ₱30.00 loose DST online through the following ePayment Channels of the BIR.. Taxpayer-applicant without existing TIN shall wait for an email instruction on when to pay or may pay the ₱30.00 loose DST at the New . Registering with the Online Registration and Update System (ORUS) at the Bureau of Internal Revenue (BIR) in the Philippines is a pivotal step for taxpayers aiming to manage their tax obligations online. This guide will walk you through the process of how to register at ORUS.BIR.GOV.PH, ensuring a smooth and straightforward experience.

We would like to show you a description here but the site won’t allow us.Registration Requirements. Primary Registration. Application for TIN. Application for Registration Update. Secondary Registration. Registration of Book of Accounts. Application for Authority to Print Receipts & Invoices. Application for Authority to Use Computerized Accounting Systems. Application for Permit to Use CRM and/or POS.

This will be made available in the BIR Online Registration and Update System (ORUS) which is one of the 49 projects of DX Phase 1. The digital TIN ID is an electronic version of the physical TIN card issued by the BIR, containing the taxpayer’s personal information. The digital TIN ID shall be honored and accepted as a valid .BIR FORM 1905 – Application for Registration Information Update. Documentary Requirements. a) Old Certificate of Registration, for replacement; b) Affidavit of Loss, if lost; and. c) Proof of Payment of Certification Fee and Documentary stamp- to be submitted before the issuance of the New Certificate of Registration.The Taxpayer Registration-Related Application (TRRA) Portal is an alternative option in submitting application for registration-related transactions to the Bureau of Internal Revenue (BIR). The application is submitted electronically through this portal via email. Taxpayer-applicants shall prepare all scanned copy of required documents to be .

Then proceed to Number 9 and fill out all the fields. Under Number 12 (“Declaration”), write your name and put your signature over it. Step 3: Proceed to the COR Update window and submit your accomplished BIR Form 1905 and other requirements for TIN card replacement. Step 4: Fill out the BIR Form 0605.It shall be used as an additional manner of serving BIR orders, notices, letters, communications and other processes to the ta. More. Secure your eFPS Account You are advised to change your eFPS log-in credentials regularly to protect your account from being compromised. To do this, log-in to your eFPS account, click "Change User Info". Follow the steps below. Get the BIR Form 1904 from the closest BIR branch. Duly fill out the form and make a copy for your file. Attach a copy of your identification document, such as a birth .

The BIR online registration for TINs enables employers to easily get TINs for their employees without having to go to the RDO. Here are the steps for the TIN application for new employees via the . Go to BIR eReg page. Enter your taxpayer profile information. Make sure every detail you provide is accurate. Double check each detail and select “SUBMIT “. Wait for an email from the BIR .

Overview. The Electronic Bureau of Internal Revenue Forms (eBIRForms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient. The use of eBIRForms by taxpayers will improve the BIR's tax return data capture and storage thereby enhancing efficiency and accuracy .TIN: - - - Username: Password: Note: Username and Password are case-sensitive. Forgot password | Enroll to eFPS | BIR Main | Help Supported Browsers: Mozilla Firefox version 40 and up; or Google Chrome version 45 and up; or Internet Explorer version 11 and up; and with 800 x 600 or higher resolution

bir tin online registration loginWelcome to theEnhanced Electronic Sales (eSales) System. is the process of reporting the gross monthly sales of taxpayers engaged in business using Cash Register Machine (CRM), Point of Sale (POS) System and Other Sales Machines (OSM) or any other similar devices through different channels. If you are an existing user of eSales System, please .Select the service that you want to avail of: Assessment Section. Set a Virtual Meeting. Client Support Section. The following transactions in the Client Support Section are available for appointment. Print Checklist of Documentary Requirements (CDR) Click Book Now to set an appointment. Register a Business. View CDR.Board of Inland Revenue (BIR) Number. Tags: BIR Number, Individual Income Tax Number, Company File Number, PAYE Number, VAT Registration. Introduction. A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number; .

bir tin online registration login|eFPS Login Page

PH0 · eServices

PH1 · eFPS Login Page

PH2 · eFPS Home

PH3 · Login

PH4 · How to get your digital TIN ID

PH5 · How to Get a TIN Number Online Using the BIR eReg Website

PH6 · How to Get a TIN Number Online Using the BIR

PH7 · How To Get TIN ID in 2023: Online Registration

PH8 · GUIDE: How To Get Your Digital TIN ID From The BIR

PH9 · BIR Home

PH10 · Application for TIN